XM is a well-established and globally recognized forex broker, having been in operation since 2009. Over the years, XM has earned a reputation for its wide range of trading instruments, low spreads, and commitment to customer satisfaction. With over 5 million clients across nearly 200 countries, XM offers a comprehensive trading experience tailored to both beginners and experienced traders with its easy sign up process.

- Regulated by multiple top-tier financial authorities.

- Ultra-low minimum deposit requirements.

- Diverse range of trading instruments and account types.

- 24/7 multilingual customer support.

- Comprehensive educational resources, including webinars.

- Fast and reliable execution with no requotes.

- Limited cryptocurrency offerings.

- No fixed spread accounts available.

- Inactivity fee applies after 90 days.

- Limited availability in certain countries, including the United States.

- Leverage restrictions in some regions due to regulatory requirements.

Overview and Regulation

XM is operated by Trading Point Holdings Ltd, which is well-regarded for its commitment to providing a transparent and secure trading environment. The broker is regulated by several top-tier financial authorities, including:

- Cyprus Securities and Exchange Commission (CySEC)

- Australian Securities and Investments Commission (ASIC)

- International Financial Services Commission (IFSC) in Belize

- Dubai Financial Services Authority (DFSA)

These regulatory bodies ensure that XM adheres to rigorous standards of financial security and client protection.

Client Fund Protection

XM maintains high standards of client fund protection:

- Segregated Accounts: Client funds are held in separate accounts from the broker’s operating funds.

- Financial Compensation Schemes: Participation in compensation schemes where applicable, providing additional protection for clients.

Account Opening Process

The account opening process at XM is straightforward and user-friendly. Here’s a step-by-step guide:

- Registration: Complete the online registration form with personal details.

- Verification: Provide necessary identification documents for KYC (Know Your Customer) verification.

- Deposit Funds: Make an initial deposit to start trading.

- Start Trading: Access your trading platform and begin trading.

XM offers a demo account option, allowing prospective clients to practice trading with virtual funds before committing real money.

Account Types and Minimum Deposit

XM offers four main types of accounts, each designed to cater to different types of traders. The minimum deposit requirements vary depending on the account type, making it accessible for traders with different levels of capital:

- Micro Account: $5 minimum deposit. Ideal for beginners.

- Standard Account: $5 minimum deposit. Suitable for all traders.

- XM Ultra-Low Account: $50 minimum deposit. Provides lower spreads.

- Shares Account: $10,000 minimum deposit. Designed for serious equity traders.

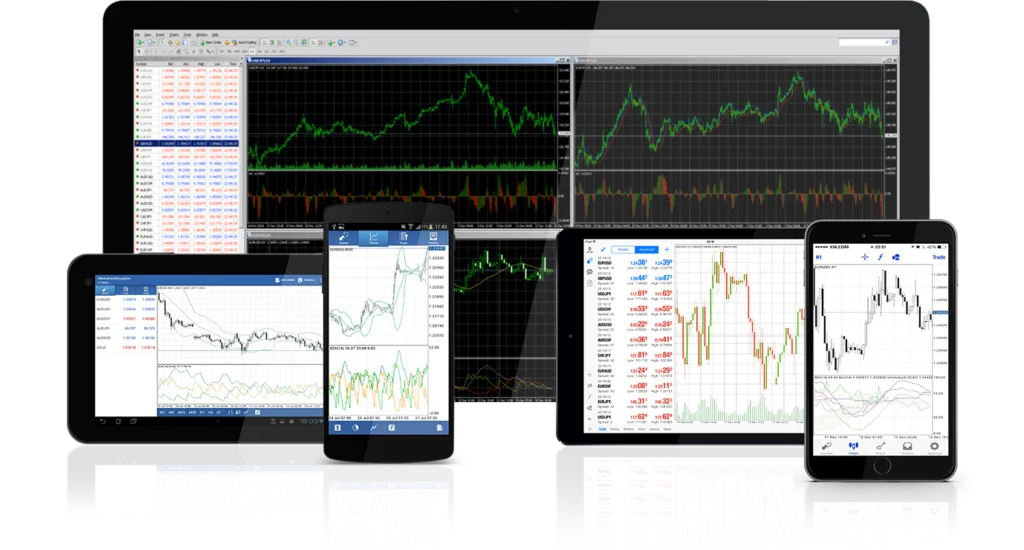

Trading Platforms

XM offers a variety of trading platforms to suit different trading styles. These include:

- MetaTrader 4 (MT4): A popular platform known for its user-friendly interface and extensive tools.

- MetaTrader 5 (MT5): An advanced platform with additional features like more timeframes and trading instruments.

- XM WebTrader: A browser-based platform offering the flexibility to trade without downloading software.

- Mobile Trading: Available on both Android and iOS, ensuring traders can manage their accounts on the go.

Spreads and Leverage

XM offers competitive spreads starting from as low as 0.6 pips, depending on the account type and instrument. The broker also provides flexible leverage options, up to 1:1000, though this varies by region due to regulatory restrictions.

XM Global Limited which onboards residents from all countries (except Australia).

Max leverage -> 1000:1

Bonuses -> YesTrading Point of Financial Instruments Ltd which only onboards EEA residents.

Max leverage -> 30:1

Bonuses -> NoTrading Point of Financial Instruments Pty Ltd which only onboards Australian residents.

Max leverage -> 30:1

Bonuses -> No

Research and Analysis

XM provides a range of research tools and analysis to support traders in making informed decisions.

Market Analysis

- Daily Market Reviews: Regular updates on market conditions, economic events, and technical analysis.

- Weekly Market Outlooks: Comprehensive analysis and forecasts for the upcoming week.

- Economic Calendar: A detailed calendar highlighting important economic events and their potential market impact.

Trading Signals

XM offers trading signals based on in-depth market analysis. These signals provide actionable insights and trading ideas to help traders make informed decisions.

Charting Tools

The trading platforms provided by XM come with a wide array of charting tools:

- Advanced Chart Types: Includes candlestick, line, and bar charts.

- Technical Indicators: A variety of indicators like moving averages, RSI, MACD, and Bollinger Bands.

- Customizable Charts: Traders can customize charts to fit their trading strategies and preferences.

Trading Instruments

XM provides access to a diverse range of trading instruments:

- Currency Pairs: Over 55 currency pairs, including major, minor, and exotic pairs.

- Commodities: Includes precious metals like gold and silver, as well as energy commodities such as oil.

- Indices: Major global indices, including the S&P 500 and FTSE 100.

- Shares: Stocks from leading global companies.

- Cryptocurrencies: Available in certain regions, including Bitcoin, Ethereum, and Litecoin.

Customer Support

XM offers 24/7 multilingual customer support to assist traders around the clock. The support options include:

- Live Chat: Available on the XM website for real-time assistance.

- Email Support: Clients can send queries via email.

- Phone Support: Support is available through international phone numbers.

The support team is known for its professionalism and promptness, ensuring that clients receive timely help with their issues or questions.

Deposit and Withdrawal Methods

XM supports a wide range of deposit and withdrawal methods:

- Credit/Debit Cards: Visa, MasterCard.

- Bank Wire Transfers: Direct bank transfers.

- E-Wallets: Popular e-wallets such as Skrill and Neteller.

- Local Payment Methods: Available in specific regions.

XM does not charge fees for deposits or withdrawals, and transactions are typically processed within 24 hours, ensuring quick access to funds.

Educational Resources and Webinars

XM places a strong emphasis on trader education, offering an extensive range of resources to help clients enhance their trading skills. These include:

- Webinars: XM hosts daily webinars in multiple languages, covering a wide range of topics from basic trading principles to advanced strategies.

- Video Tutorials: A library of videos that cover everything from platform tutorials to market analysis.

- Trading Tools: XM provides various tools like economic calendars, calculators, and market research reports.

- Seminars: XM regularly hosts seminars and workshops in various countries to provide hands-on training to traders.

Bonuses and Promotions

XM occasionally offers several promotional deals, including a no-deposit bonus, deposit bonuses, and loyalty programs. However, these promotions are subject to regional regulations and may not be available in all countries. Those offers, are available usually during major holidays or announcements by XM Forex Broker. They can be found listed here when they are released.

Security and Transparency

XM takes client security seriously, implementing advanced encryption technologies and segregating client funds in top-tier banks. The broker also provides negative balance protection, ensuring clients cannot lose more than their initial investment.

Availability and Global Presence

XM is available in nearly 200 countries, with a strong presence in Europe, Asia, the Middle East, and Africa. The broker is, however, restricted in some regions, including the United States, Canada, and certain countries in the European Union.

Customer Reviews and Feedback

Positive Feedback

Many traders appreciate XM for:

- User-Friendly Platforms: The intuitive design of MT4 and MT5 platforms.

- Excellent Customer Support: Responsive and helpful customer service.

- Educational Resources: Comprehensive webinars and tutorials.

Areas for Improvement

Some areas where traders have suggested improvements include:

- Extended Trading Hours: Offering more flexibility for trading during off-hours.

- Additional Payment Methods: Including more options for deposits and withdrawals.

Conclusion: Should You Trade with XM?

In conclusion, XM is a solid choice for traders of all levels, offering a wide range of trading instruments, competitive spreads, and robust regulatory oversight. Whether you are just starting your trading journey or looking to switch to a more reliable broker, XM has the tools, resources, and support to help you succeed. With its low minimum deposit requirements, diverse account types, and commitment to client satisfaction, XM is well worth considering for your forex trading needs.