You’ve probably heard of them in the last few days, Freedom24 has been spending a lot of money on advertising past in the past few months. It’s not just another broker in the vast sea of investment platforms; it brings some unique features to the table, especially when it comes to ease of use, fees, and innovative offerings like IPO investments. Let’s take a closer look into my experience and analysis of the platfrom through this Freedom24 Review as an upcoming Forex Broker Platform to see whether it stands out as a solid contender for your trading needs, specifically when considering Freedom24 forex trading.

Pros & Cons of Freedom24 Forex Broker

Overview of Freedom24

Freedom24 is part of Freedom Finance Europe Ltd, which offers a wide range of investment services including stocks, bonds, and options. The platform is most well-known for its IPO offerings, which allow you to buy into companies before they go public. But how does it fare when it comes to forex trading? Here’s a breakdown of my own experience with the platform highlighted in this Freedom 24 Review.

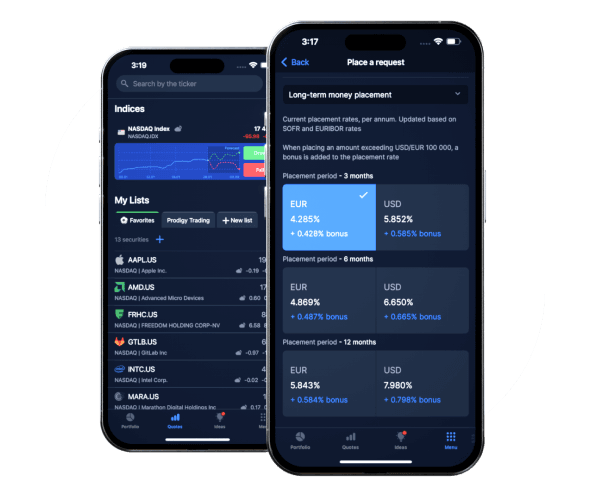

Trading Platforms

According to this Freedom24 Review, it offers both a desktop and mobile app version, making trading accessible wherever you are. Whether you’re a novice or a seasoned trader, the platform is user-friendly. The Freedom24 mobile app is available on both iOS and Android, and I found it smooth and quick, with the added advantage of keeping me informed with real-time market data and alerts. Compared to other platforms like MetaTrader 4 or 5, Freedom24’s app might not have as many advanced charting tools, but it more than makes up for this with its easy navigation and straightforward execution of trades. For someone who doesn’t need too much complexity in their charts, this is more than sufficient.

Forex Fees Structure

Now, let’s talk about fees— which is always an important factor when deciding which broker to go with, if not the most important one. Freedom24’s forex fees are relatively competitive. For instance, stock and ETFs fees in Europe and the U.S. are around 0.5% of the transaction volume plus a minor $0.012 per share and $1.20 per order depending on your service plan. Additionally, the platform charges no deposit fees but has a withdrawal fee of €7 per transfer (bank transfer) or 0.65% via card. For forex traders, the fee structure for currency conversions can be a bit steeper due to spreads (around 0.2% on average for EUR to USD conversions).

Importantly, Freedom24 does not charge inactivity fees, which is a bonus compared to competitors that might penalize you for not trading. The margin rates are around 0.049315% daily for EUR accounts, equivalent to approximately 18% per year, which aligns with industry standards.

Regulation & Security

When it comes to safety, Freedom24 is well-regulated. The platform is overseen by the Cyprus Securities and Exchange Commission (CySEC) and complies with MiFID II standards, ensuring the safety of funds and transparency in their operations. For investors based in Europe, this regulation gives an extra layer of security as CySEC is a well-respected financial watchdog.

However, U.S. clients should note that Freedom24 does not accept U.S. residents due to regulatory constraints.

Minimum Deposit & Withdrawal

The minimum deposit at Freedom24 is as low as $1, which makes the platform very accessible to beginners. As for withdrawals, the minimum amount for bank transfers is €7, which is fairly standard. However, withdrawals via card are subjected to a fee of 0.65% (not less than €2), so that’s something to be mindful of.

Awards & Recognition

Freedom24 won the Best Online Broker 2022 Award from OnlineTraders.gr, recognized for its innovative approach to IPO trading and its wide range of tradable assets. This award signifies the platform’s commitment to providing a seamless and trustworthy trading environment. Although they have maintained the quality of their services, there’s room for improvement, especially in terms of educational content and market research compared to industry giants.

Educational Resources

Freedom24’s educational content is decent but not quite at the same level as some of the big names like Interactive Brokers or Saxo Bank. They offer a handful of tutorials and market updates including an Academy, but if you’re a beginner or looking for deep market analysis, you might find their offerings a bit lacking. Other platforms have more comprehensive resources to build your trading skills. Although they do offer access to 15 Global Exchange markets and over a million trading instruments.

How to Sign Up and Log In

Signing up for Freedom24 is a straightforward process:

- Visit the website or apps and click on “Sign Up.”

- Enter your personal details and verify your email.

- Complete the KYC process (Know Your Customer) by uploading documents like a passport and proof of address.

- Once verified, you can fund your account and start trading.

The login process is a bit tedious and would recommend using the app, where you can enable two-factor authentication for added security and bypass some of the issues we faced on the web version. The platform supports seamless integration with multiple devices, so you can trade anywhere, anytime.

Freedom24 Forex FAQ

1. What is the minimum deposit for Freedom24?

Freedom24 has a low minimum deposit requirement of $1, making it accessible for traders of all levels.

2. Are there withdrawal fees on Freedom24?

Yes, there is a €7 fee for bank transfers and 0.65% for card withdrawals.

3. Does Freedom24 charge inactivity fees?

No, Freedom24 does not charge any inactivity fees, which is beneficial for traders who may not trade frequently.

4. Is Freedom24 regulated?

Yes, Freedom24 is regulated by the Cyprus Securities and Exchange Commission (CySEC) and complies with MiFID II regulations, ensuring a secure trading environment.

5. Does Freedom24 accept U.S. clients?

No, due to regulatory restrictions, Freedom24 does not accept U.S. clients.

6. What trading platforms does Freedom24 offer?

Freedom24 provides both desktop and mobile app platforms, with the app available for iOS and Android. The mobile app offers real-time data, trade execution, and alerts.

7. What are the forex trading fees on Freedom24?

Forex fees are competitive, but there are currency conversion spreads (around 0.2%) and margin rates that apply.

If you’re looking for a platform that combines forex trading with the chance to invest in IPOs, Freedom24 is definitely worth considering. The app is user-friendly, fees are competitive, and the platform is regulated by CySEC, providing peace of mind for European traders. However, if you’re focused simply on forex trading or require additional more advanced educational resources, you might find better alternatives elsewhere from our list of highly ranked brokers.